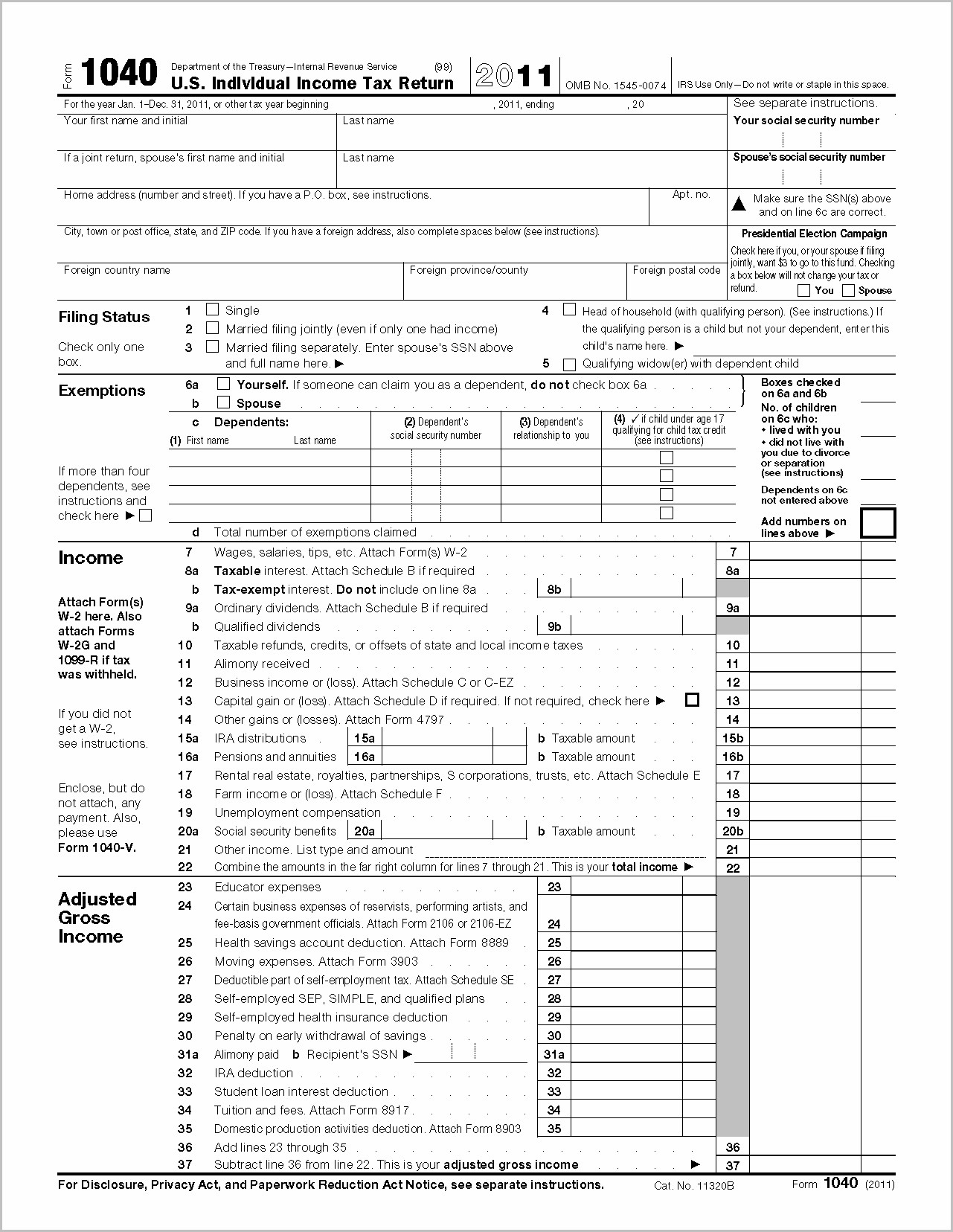

IRSS 1040 INSTRUCTIONS FREE

Not a Long Form 1040 income tax return filer? You can also obtain free printable Easy Form 1040EZ Instructions and Short Form 1040A Instructions on our website. 1040 and then received a refund in 2021 from the Stateor your local unit of government for a portion of those taxes,you must include that refund as income on your2021 U.S.Form 1040. You can print, fill-in, and mail your 2017 Form 1040 before the official opening date.įorms W-2 from employers, Forms 1099 from banks and sub-contract work, and other important tax documents are generally due to you by January 31, 2018.Ĭontact your employer's payroll department after this date if you do not receive your W-2, or, if you recently moved and need to ask for a copy.

The IRS will begin processing paper and electronically filed federal income tax forms on January 29, 2018. Visit our Form 1040 page to view a complete list of federal income tax forms including the above 2017 Form 1040 Instructions booklet. See the instructions for Form NJ-1040-HW on. See the instructions for Form NJ-1040-HW on page 47 Provided care for a disabled veteran who is related to you and lived with you, you may be eligible for a Wounded Warrior Caregivers Credit. Free File is the fast, safe, and free way to prepare and e- le your taxes. Are a homeowner or tenant age 65 or older or disabled, you may be eligible for a Property Tax Credit.

Do I need to file an income tax return chart. On the second page of Form 1040, you’ll calculate your tax liability. Make sure you have the forms you need to file your taxes.

0 kommentar(er)

0 kommentar(er)